Once essential for interbank transfers and major commercial settlements, high-denomination bills like the $500 and $1,000 notes are now prized collector’s items. Though discontinued in 1969, these rare notes have soared in value, fetching tens of thousands of dollars at auctions. This 2025 guide explores their origins, values, and expert tips for identifying and selling these historic pieces.

History of the $500 Bill

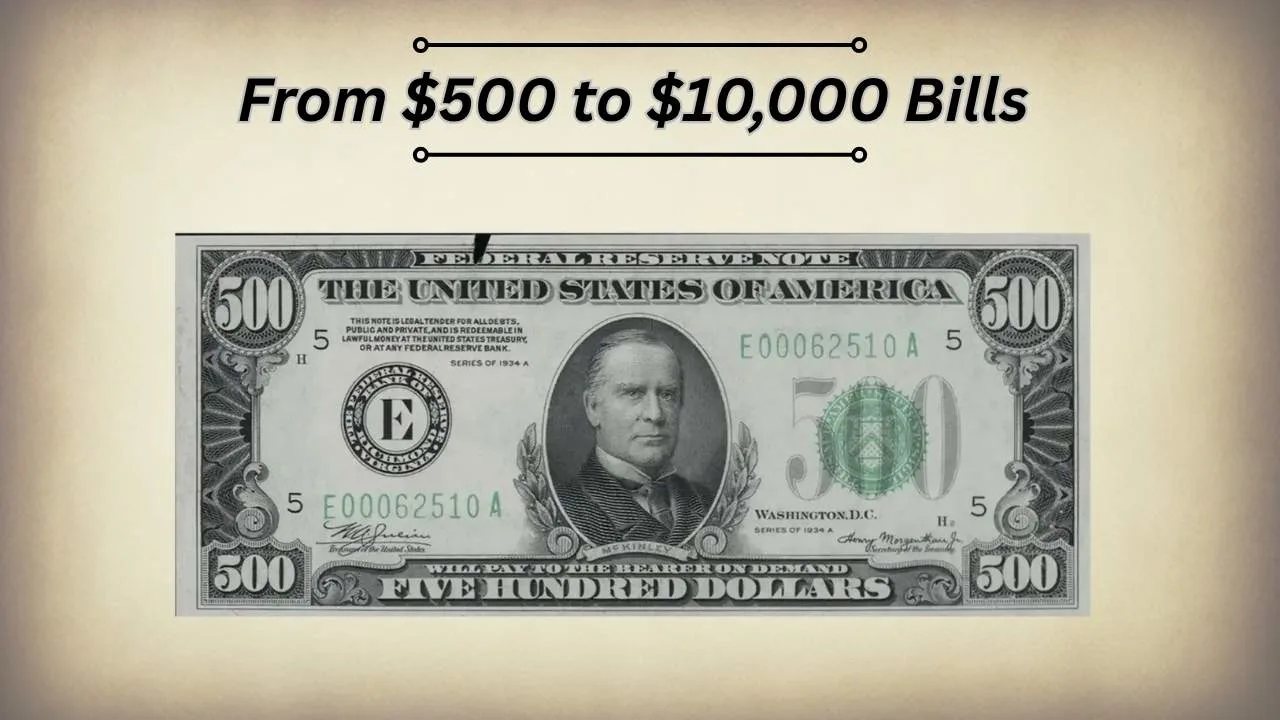

The $500 bill first appeared in 1861 to facilitate large transactions before wire transfers existed. While early issues featured Chief Justice John Marshall, the most recognised version — reissued in 1928 and 1934 — bears the portrait of President William McKinley.

Why McKinley?

McKinley’s presidency (1897–1901) symbolized economic expansion and postwar prosperity. His policies strengthened U.S. business confidence, making him an ideal choice for a note representing stability and financial power.

The 1918 “Blue Seal” note featuring Marshall remains an especially valuable rarity. It showcased a grand reverse engraving titled “De Soto Discovering the Mississippi.”

Characteristics of the $500 Bill

| Feature | Detail |

|---|---|

| Portrait | William McKinley |

| Obverse Design | Central portrait, ornate borders, bold numerals |

| Reverse Design | Simple “500” in large font |

| Dimensions | 6.14 x 2.61 inches (same as modern U.S. currency) |

| Seal Color | Green (1934); earlier notes used red or blue seals |

| Serial Numbers | Green ink, varies by district |

| Series Dates | Primarily 1928 and 1934 |

| Paper Type | Cotton-linen blend |

Why Were $500 and Other Large Bills Created?

Before digital banking, high-value notes like the $500, $1,000, $5,000, and $10,000 were used for large-scale transfers between banks. They were never intended for everyday use, which is why so few entered public circulation.

After World War II, wire transfers and checks replaced these large bills. By 1969, the Treasury officially discontinued denominations over $100, citing both declining use and potential misuse in organised crime.

Are $500 Bills Still Legal Tender?

Yes. All high-denomination bills remain legal tender in the U.S. However, their collector value far exceeds their face value. Spending one would be like trading a rare vintage car for retail price.

Expert Insight:

“Every surviving $500 note is effectively a historic asset. Spending it would be financial malpractice,” says James McCarthy, senior numismatics appraiser at the American Currency Guild.

Collector Value in 2025

While face value remains $500, actual market prices depend on condition, series, and rarity.

Factors That Affect Value:

- Series and Seal Color: 1934 green seals are more common; 1928 and 1918 series command premiums.

- Condition: Crisp Uncirculated (CU) notes bring exponentially higher prices.

- Serial Numbers: Fancy serials (e.g., 00000025 or 12344321) boost worth.

- Issuing District: Some Federal Reserve districts had smaller print runs.

Table: 2025 Market Value Range

| Grade | Typical Price (1928 Series) | Typical Price (1934 Series) |

|---|---|---|

| Very Fine (VF) | $1,500 – $2,500 | $1,300 – $2,200 |

| Extremely Fine (EF) | $2,800 – $4,500 | $2,500 – $4,000 |

| Crisp Uncirculated (CU) | $5,000 – $10,000+ | $4,500 – $8,000 |

| Star Notes / Rare Serial | $8,000 – $20,000+ | $6,000 – $15,000+ |

Comparison: Rarer Notes and Their 2025 Values

| Denomination | Portrait | Typical 2025 Collector Value | Notes |

|---|---|---|---|

| $500 | William McKinley | $1,500 – $10,000+ | Most attainable high-value note |

| $1,000 | Grover Cleveland | $2,800 – $20,000+ | Popular with private investors |

| $5,000 | James Madison | $90,000 – $200,000+ | Fewer than 250 known survivors |

| $10,000 | Salmon P. Chase | $200,000 – $500,000+ | Rarely seen outside museums |

How to Sell or Appraise a $500 Bill?

1. Professional Appraisal

Seek expert verification from a certified currency appraiser or numismatic dealer.

2. Grading Services

Submit to a third-party service such as PMG (Paper Money Guaranty) or PCGS Currency for authentication and encapsulation. Certified notes sell faster and fetch higher prices.

3. Auction or Dealer

For high-value examples, consider major auction houses like Heritage Auctions or Stack’s Bowers.

4. Private Sale Precautions

If selling online (eBay or private collectors), ensure clear, high-resolution photos and verify credentials of the buyer.

Preservation Tips for Collectors

- Never clean your bill. Cleaning can destroy original paper texture and ink, slashing its grade.

- Store in a protective sleeve. Use acid-free, clear holders and keep away from heat and sunlight.

- Handle with cotton gloves. Oils from hands can stain or weaken paper fibers.

- Avoid folds or rolls. Flat storage preserves grading quality.

Collector’s Advice:

“Even a single fold can cost thousands in resale value. The best preservation is minimal contact,” says Sarah Jensen, curator of the National Currency Museum.

Why the Value Keeps Rising?

As time passes, attrition continues. More notes are lost, destroyed, or locked in long-term collections. Demand from both domestic and global collectors continues to grow.

The high-denomination note market has proven resilient against inflation, making them attractive to investors seeking tangible, historical assets.

Final Thought:

If you’re lucky enough to possess a $500, $1,000, $5,000, or even $10,000 bill, you’re holding a tangible piece of American financial history. In 2025’s thriving collectors’ market, these notes are more than currency — they’re relics of a bygone era, appreciated not just in dollars but in cultural and historical value.

FAQs

Technically yes, but it’s unwise. Its collectible value is much higher than $500.

Check for correct paper texture, seal colour, and serial format. Professional grading provides definitive verification.

A 1918 “Blue Seal” note featuring Chief Justice John Marshall sold for over $60,000 in top condition.

Yes, both existed for interbank transactions. They’re now ultra-rare and worth six figures or more.

Cleaning, writing, folds, repairs, or discoloration drastically lower market price.

Major numismatic auctions or certified currency dealers are safest and most profitable.